Whenever you mention the magic words, “ Mutual Funds, Stock Market or Equity investing”, you get extreme reactions, suddenly the investor starts expecting overnight fortune and magic returns. Expectations are that money will double or triple in the immediate future.

Every investors has a story, about how they have lost a fortune in the last crash and there will be others, a minority though, who have gained tremendously with stories about how the Reliance stock took care of his daughter’s wedding or the initial allotment of Infosys helped him buy a house.

However, Investor after investor, client after client that we meet, have been unable to beat the market returns. There is definitely a pattern and it needs to be studied and learnt from so as to maximise the returns from your investments.

Why aren’t so many retail investors able to beat the returns from the indices like Nifty or the Sensex despite the fact so many stocks have become ten baggers and even hundred baggers in the recent past?

If the investor has not made money, who is to be blamed, The Investor or the Market?

The market has grown 380 times in the last 38 years. Just to make it simple, on an average of 10 times in a year, but still majority call the market a gamble. Agreed, the growth has not been linear, it has been volatile, but still it beats all asset classes hollow by multiples.

I know of at least 25 Equity mutual funds, which have grown at an average of 25 times in the last 15 years and almost a similar number where the fund has grown more than 3 times in the last 5 years. Most investors dream of this return, but are unable to garner the same.

Even in the U.S., The results of research done by Dalbar Inc., a company that studies investor behavior and analyzes investor market returns, consistently show that the average investor earns below-average returns. For the twenty years ending Dec 2015, the S&P 500 Index averaged 9.85% a year, whereas the average equity fund investor earned a market return of only 5.19%.

The market has delivered as promised, but the investor is doing something wrong which is not making him get reap the benefits. Hence, the blame definitely does not lie with the market, but the investor.

We need to examine that and the common investor pitfalls before we go onto deciding the financial plan and strategy.

Why is this happening?

There are many reasons; we are just listing out the most common pitfalls that most investors fall into.

One of the major reasons that we have noticed is that most investors don’t understand the difference between investing and trading. Investing is for long term and should be linked to goals whereas trading is a daily activity and needs to generate profit at regular intervals by buying and selling. The parameters are different. Unfortunately all news flow, all TV channels, the so called zero brokerage sites, stock calls etc. are all aimed at the traders for the short term, but the decisions on the calls are being made by the Investors who have invested for the long term.

There is an old saying, “Before acting on an advice, check out who is paying for the advice and who will gain from the advice” The only people who gain from all of the above are the Brokers and those making the calls, nor the trader and definitely not the investor.

As compared to other asset classes, one of the biggest advantages of Equity is the Liquidity that it offers. However that is also the biggest impediment in long-term wealth creation. Being highly liquid, whenever in need of money or whenever the market corrects, or on a slightest impulse, equity can be sold and encashed. Whereas the other asset classes like real estate cannot be portioned/divided for sale, nor can it be sold immediately during a downturn and hence over time it tends to grow.

The other reason why this happens is the low cost of buying and selling equity. The decline in the cost of trading is one of the worst things to happen to investors. It made trading possible.

Consider the scenario of an investment in real estate; the hidden costs are as high as 10% to 15% of the total property value out of which 7% is just the property registration cost and 1-2% brokerage etc.

Such high cost makes sure you aren’t trading in the real estate market on a regular basis and you will buy and hold for a longer period.

Now consider the cost of trading in the market, 0.5-1% at most brokerages and even lower than 0.1% with low-cost brokers like ZeroDha.

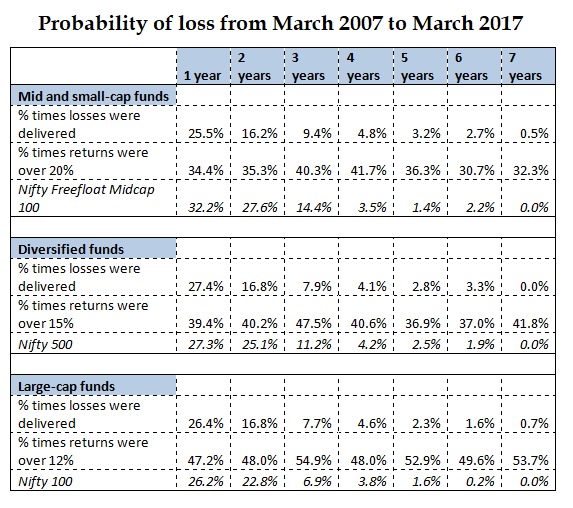

We have been receiving a lot of queries after the recent corrections, “Should I Invest now?” Our single point reply has been – What is your investment horizon? If more than 5 years, please do so but if you are looking for making some quick money by investing or entering the market now, the market may disappoint you, as by its very nature it is volatile. If you are invested for more than 5 years, history shows that the probability of loss comes down tremendously.

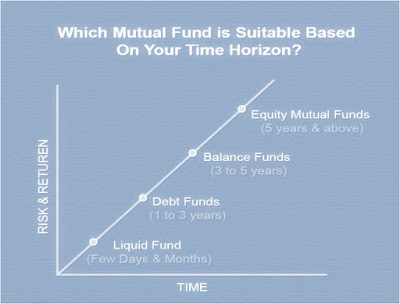

Investors also need to understand the risk return matrix, in Mutual funds alone, there are different mutual funds for different investment horizons and that should be followed religiously to optimize risk and return.

Your minimum time frame has to be in line with the minimum ideal time frame for the product you choose. At least a 5-year time horizon for an equity fund or not less than 3 years for an income fund and so on are basic rules that you need to follow. No point blaming the product when you do not follow the investing rules for it.

The other major reason however, is that Investor behaviour is illogical and often based on emotion. This does not lead to wise long-term investing decisions.

When it comes to money and investing, we're not always as rational as we think we are – which is why there's a whole field of study that explains our sometimes-strange behaviour.

Most often, investor returns are quite low compared to investment returns because of what Carl Richards, a best-selling author, calls “Behavior Gap.”

Many clients associate risk with volatility. They feel that certain asset classes like equity are very risky owing to the frequent rise and fall in the market. Most people feel the pain of losing more strongly than the joy of gaining. This higher sensitivity to losses is nothing but “loss aversion” bias. Studies show that people react twice more strongly to loss than profit. To elaborate, a loss of Rs. 50,000 feels more painful than the gain of Rs.1 lakh.

Many investors invest only in safe products due to the fear of loss. Other examples of loss aversion bias are - an investor selling his investments at a marginal profit fearing correction in markets and an investor holding on to a weak stock hoping that its price will go up.

Investors get optimistic when the market goes up, assuming it will continue to do so. Conversely, investors become extremely pessimistic during downturns. A consequence of “Anchoring”, or placing too much importance on recent events while ignoring historical data, is an over- or under-reaction to market events which results in prices falling too much on bad news and rising too much on good news.

At the peak of optimism, investor greed moves stocks beyond their intrinsic values. Extreme cases of over- or under-reaction to market events leads to market panics and crashes.

Many investors also believe they can consistently time the market, but in reality there's an overwhelming amount of evidence that proves otherwise. Overconfidence results in excess trades, with trading costs and risks denting profits.

We all want to beat the market somehow, to be able to gain more, or to boast amongst our peers over a cocktail. It is something like when we are cruising along the highway towards our destination, and suddenly a car whizzes past, and we just want to get ahead of that car. We start speeding and taking unnecessary risks even though we know that we will reach our destination in the desired time without taking this risk.

Most people we meet want to be overnight billionaires.

I can tell you a list of stocks, which have been ten baggers and more in this millennium and are geared to and will possibly give a more than 20% CAGR in the next ten years also. This means that your money will grow 10 times in the next ten years. But, how many will have the patience to wait that long or the stamina not to encash when their investment doubles rather than wait it out for 10 years or for their financial goal period.

The important aspect is to remain invested in the same stock even after the first year and after you have made 25% returns from it. Often investors move to some much better “opportunity” and in the process lose out.

The main reason for an investor looking to beat the market and make the most of it is because we look for new opportunities rather than riding out the opportunity that we already have. Ramesh Damani, the marquee Investor once famously said, “After all my years in the market, I have learned, that just because a stock doubles, it is no reason to sell it.”

We have just learnt one thing after all our time in the market. Instead of focusing on Large, mid or small cap, focus only on one thing and that is the Long Cap. One sure shot way of making money in the market is to have conviction in equity as an asset class, invest for the long term and let compounding do the balance. Do a half yearly review with your financial advisor and let the market do its job.

To end this topic, Iam reminded of the most apt couplet from Saint Kabir, which should be religiously followed by all investors.

Happy Investing!

Stay Blessed Forever!

Sandeep Sahni

Very very good

ReplyDeleteThank you so much to share such an amazing and informative article about investment advisor in toronto. Keep us updating with more interesting articles.

ReplyDelete