In recent times, if the sea of red on your portfolio statement is prompting you to lose faith in equity investing, your mind is telling you to stop your SIPs and go back to FDs, just remind yourself of, why you began to invest in equity in the first place.

If you started your equity-fund SIPs to save up enough for buying a home or to fund your child's college degree or to retire early, will moving away from Equity help?

Do you need the money immediately?

What are the alternatives?

Have the fundamentals changed for the long term?

The last few quarters have been rather gloomy for Equity investors. Commentators have been promising markets will improve after the Elections, then saying improvement will come after the budget, some saying after the trade wars settle down or when the earnings start improving. It has now reached a stage where the doomsdayers are predicting a major crash, everyday the social media is loaded with impending corporate scandals, repeat of Lehman crisis and God knows, rumours of how many companies going bust.

Markets have always been dynamic, the path they follow is never linear and markets change every hour. However, human nature barely changes.

The price of a stock is still determined by people. As long as people let fear, greed, hope and ignorance cloud their judgment, they will continue to misprice stocks and provide opportunities to those who rigorously use simple, time-tested strategies to pick stocks. Names change, Industries change, technology disrupts, Styles come in and out of fashion, but the underlying characteristics that identify a good or bad investment remain the same.

It is extremely difficult to go against the crowd—to buy when everyone else is selling or has sold, to buy when things look darkest, to buy when so many experts are telling you that stocks in general, or in this particular industry, or even in this particular company are risky right now. Investments start looking dangerous when the Macros or the economy as a whole may appear to be slipping. But, if you invest where everyone else is investing, buy the same securities everyone else is buying, you will have the same results as everyone else. By definition, you can’t outperform the market if you buy the market. And chances are, if you buy what everyone is buying you will do so only after the story is over and it is already overpriced.

Historical Data as per the details below, shows that every correction is an opportunity to buy and those brave enough to put their money in a downturn get handsome returns.

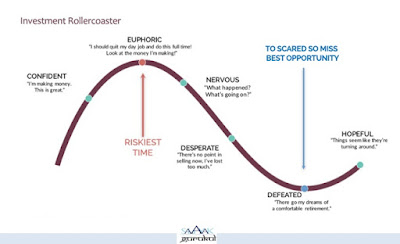

Investors don’t differentiate and behave as irrationally after protracted bear markets as they do after Bull market manias; buying at or near the peak and leaving the equity markets in droves, usually at or near the market’s bottom. By the time they gather enough courage to venture back into equities, a major portion of the recovery has often already happened.

Most Investors Spend 90% of their time thinking the next 5 - 10% Index Move, while wealth is created only by investing for the long term and catching long term trends.

We all love forecasts and always look for bits and pieces of information which basically reinforces our hypothesis regarding the market. This is what is called Confirmatory Bias and we all suffer from it.

(Check out our earlier blog on the subject : “Market Forecasts - Kaisi lagti hai market” https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8558-market-forecast-kaisi-lagti-hai-market-2 )

We are always trying to second guess the market, but the facts are clear—there are no market timers on the Forbes 500 list of the richest people, whereas most of them are long term investors.

At different times there will be different reasons for volatility in the market. It is important to recognize that and attach the requisite importance to market valuation.

Past performance is not indicative of future returns – Most mutual funds and investment houses put forth this disclaimer. But past performance and by that we are not talking about recent past, but historical data, is an important parameter to consider while investing. You cannot ignore historical performance by saying “it is different this time”. Historical data gives some idea of the asset class and the trend of returns given by the investment in a particular asset class over long periods of time.

In finance, the theory of “Mean Reversion” suggests that a stock's valuation or the market valuation will tend to move to the average valuation over time. Every asset class has an average, or fair value. Whether the current value goes much higher or drops dramatically from that level, the market will eventually move it back to the average or reverse it to the mean. It’s a matter of when and not if. Hence if the market is trading much above the mean, it will have to correct and if it starts trading much below the mean, it will gain and reverse to the mean.

People invest in Equity and they look at the price the next morning and next month and next year and they decide to see if they are doing well or not doing well. They immediately start comparing with other asset classes; If I had invested this money in FD, it would have been 1.06X after one year and here I ‘am at 0.95X and so on.

The reasons for investing in Debt or equity or Gold are totally different and cannot be compared, then why compare the returns in the short run.

The equity markets grow in spurts, your investment may do nothing for two or three years and suddenly, it will double in the next two years, giving you your 15% CAGR as against the 6 - 7% in fixed income securities. Historically, a 10 – 15% correction usually lasts for about 3 to 4 months – the market then bottoms out and up trend resumes. When the market falls more than 20%, the correction is termed as Bear market. A bear market is more severe than a correction. A bear market usually takes a year to bottom out and start recovery. In the last 12 years, the market fell more than 20% in 2008, 2011 and 2015 / early 2016. Since 1991 we have had seven bull markets and six bear markets of varying time periods and intensity.

(Check out our earlier blog on the subject : When will this correction end

Everybody is a genius in a Bull Market, but one’s wisdom is only tested in a correction or a bear market.

I ’am reminded of the Golden words written by Benjamin Graham more than seventy five years ago, “With every new wave of optimism or pessimism, we are ready to abandon history and time-tested principles; but we cling tenaciously and unquestioningly to our prejudices.”

Wealth creation from Equity is a very boring process, you have to have the conviction to ride the volatility, you have to be consistent, you have to have tons of patience, you have to leave your investment alone and not watch it change daily, and only then can you create wealth from Equity in the long run.

(Check out our earlier blog on the subject : “Is it time to buy equity” https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8168-is-it-time-to-buy-equity )

Stick to your asset allocation and do not try to time the market.

Consult your financial advisor, stick to the fundamentals, go back to the basics on the Why of Investment and if the basics and fundamentals have not changed, then why change because of the volatility of the market.

Happy Investing!

Stay Blessed Forever

Sandeep Sahni

Note: All information provided in this blog is for educational purposes only and does not constitute any professional advice or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.

About The author

Sandeep Sahni

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988). His also an alum of Shri Ram College of Commerce, Delhi University (B.Com. Hons. Class of 1985.)

Sandeep's investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and has been advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.He also writes a well read blog;

He has also conducted presentations, workshops and guest lectures at Management institutes for students on Financial Planning and Wealth Creation.He can be reached at:+91-9888220088, 9814112988

Follow us on: