You need to

look in the mirror and answer, Are you taking enough risks to meet your goals?

Although it

is often used in different contexts, Risk is the possibility that an outcome

will not be as expected. Specifically in finance, it is always discussed with

reference to returns on your investment. Risk implies future uncertainty

about deviation from expected earnings or expected outcome. Risk measures the

uncertainty that an investor is willing to take to realize a gain from an

investment.

Great things

never come from being in your Comfort zone. In order to grow, we need to take

risks, whether in businesses or in our careers.

Generally we take risks because there’s a gap

between where you are now and where you want to be.

Risk and return go hand in hand

and have a direct correlation, you want to become rich and grow your wealth,

you must take the necessary risks.

Most

investors consider risk only as loss of capital or the reduction in corpus,

whereas to assess risk in the true sense, we need to also consider the risk in

valuation of the corpus or reduction in purchasing power due to inflation and

also the opportunity cost of capital. The benchmark for inflation should not be

the Government sponsored WPI or CPI but also factor in the Lifestyle inflation.

As I’am fond

of saying in most investor interactions, “Ten years ago, who would have thought

that we will buy a Rs 50000 phone on a whim or as a Gift for a loved one every

year.” Hence the need to factor in lifestyle inflation in your investment

strategy.

While

comparing investment options, we have experienced that most investors also

ignore the tax implications and the impact taxes can have on the erosion of the

corpus. Another impact, taxes have, is on the values at which your corpus will

compound every year.

Taxes on

Interest income are on accrual whereas taxes on mutual funds or equity are on

redemption thereby impacting the value of the corpus at the end of each year. E.g.

Lets say you have Rupees one lakh and you buy an FDR @ 6%, your corpus would

grow to Rs 106000 less tax @ 30% i.e. Rs 104200 and next year you would get

interest on Rs 104200. The same amount invested in a Debt Fund @ 6%, would also

grow to Rs 106000, but because tax is only applicable if you redeem, next year

also you would get interest on Rs 106000. The investment over a period of 5

years will lead to a substantial difference due to this factor alone.

Hence, as a

first rule, your investment must generate a return, which beats inflation post

taxes. If you are not able to do that, then you run the risk of losing the

purchasing power of your investment even if your corpus remains intact.

Between the

two major financial asset classes, Equity and Debt, Equity is generally

associated with risk and Debt with safe and steady returns.

The problem

arises when the investor starts taking risks in Debt Investment. The risk in

Debt has been highlighted by the recent FMP crisis and the NBFC defaults,

wherein the investors have lost or are very close to loosing their hard earned

corpus invested in “Safe” Debt.

Risk is for

equity and should deliver the option of higher returns but alas, for a few

extra basis points or an extra percentage return, investors end up investing in

low credit and below par Debt instruments thereby also exposing themselves to

the risk of default.

The portion

you need to invest in Debt as a part of your Asset allocation strategy, should

be in low risk or virtually zero risk options like Government Bonds, FDRs, PPF,

Arbitrage and liquid funds and the like. Please don’t look at an extra return

on your Debt investment and always remember that a higher return can only come

with a higher risk.

The Problem

is not taking too much risk but taking too less risk or taking risk where it is

not required or in the wrong asset class.

Indian

investors have been playing too safe with their investments. Our investments

are dominated by Debt, our portfolios are largely concentrated in FD's, PPF,

RD's, traditional endowment insurance policies (since we get a fixed amount on

maturity), Post Office Schemes, etc.

Warren

Buffett said “Risk comes from not knowing what you are doing”

You need to understand

the vagaries of different asset classes, the risk and return matrix of each

option, to make a wise investment choice and decision.

Numerous

studies and the chart below also clearly illustrates that no asset class can

beat Equity in terms of returns in the long term. Sensex has grown almost 390

times in its 40-year journey from 1979 as compared to 35 times in Gold and 22

times in FD.

A study of

the history of the equity and other asset classes helps us study the probability

of loss while investing in an asset class. One of the major determinants of the

choice of asset class is dependent on the time horizon you have to reach your

goal. To get the best returns from Equity, you need to give it a minimum of

five years and above as is evident from the chart below.

The probability of loss in Equity Mutual

Funds becomes zero in 5 years, whereas in Sensex, it is only 9% after 5 years

and progressively reduces to zero in 12 years.

The 2008

Stock market crash was one of the biggest crashes in the recent history of the stock

markets. The Sensex reached its peak level on 8thJan 2008 when it

touched 20873. Subsequently when the financial crisis unfolded, the markets

dropped by close to 65% to reach the lowest level wherein it hit 7,697.39

intraday and closed the day at 8,509.56 on Oct 27, 2008. After touching a

low of 7,697.39 on Oct 27,2008 Sensex slowly recovered to re-scale 21,000

on Nov 5, 2010 thereby erasing all losses in less than three years.

Lets take

two scenarios; in the first scenario, lets assume that you were unlucky and you

bought the Sensex on 8thJan @ 20873. Subsequently the market started

crashing and you held onto the Sensex for 10 years. On 8th Jan,

2018, it had reached a level of 34353 thereby giving you an absolute return of

65% and a CAGR of 5.11%

In the

second scenario, lets assume that you sold at the lowest point of the market,

on 27thOct 2018at a Sensex level of 8000. If you had bought it Five

years ago the Sensex, on the same day, was @ 4698.28, thereby giving you an

absolute return of 70% and a CAGR of 11.23%.

Hence, even

if you buy at the highest point or sell at the lowest point of the market, if

you have a five-year horizon and more, you will have a lesser probability of

losing money in the equity market.

According

to a study done by investment firm Deutsche Bank, the stock market, on an

average, has a correction every 357 days, or about once a year. While many investors,

especially those new to Equity investing simply aren't used to experiencing

swings like these, but corrections are an inevitable part of stock market.

However,

these corrections offer a major opportunity to buy and gain substantial returns

in the next one to three years.

In a

broader context, while a stock market correction is an inevitable part of stock

ownership, corrections last for a shorter period of time than bull markets.

Based on

research conducted on the Dow between 1945 and 2013, John Prestbo at

MarketWatch determined that the average correction (which worked out to 13.3%)

lasted a mere 71.6 trading days, or about 14 calendar weeks. The Indian Bear

& Bull cycles are also highlighted below and also show a similar trend.

Hence Equity

is also not risky if you have the conviction in the asset class, understand the

market dynamics, have the patience and have a long-term horizon. You may only need

the help of a financial advisor who can help you ride the volatility. He will

also help you make investment decisions based on the current market valuations.

Historically

NIFTY trades at PE of 18 and gives the best return when it trades near or below

the historical levels.

As is

evident from the above data, long term Equity investment can balance the risk

and provide better returns if you have the right time horizon.

If your

horizon is less than five years, you need to shift to Debt or safer asset

classes.

However,

most investors stick with debt despite having a longer time horizon. The

problem with being too conservative is, it leads to sub optimal returns over

the long term, which may hamper the achievement of your financial goals.

The risk

quotient is always subjective; it varies from case to case. The Risk should be

in conjunction with the returns you need.

The Golden

Rule is Young Investors should take more Risk and the older ones should take

less risk. The real risk actually arises when the value of your investment is

less than the value of your goal. Of what use will be a retirement corpus,

created after saving since the last 30 years in 6% FDs, when it will only be

enough to last the next 10 years only, post retirement, when even an additional

4% return created from balancing risk, would have lasted for more than 25

years.

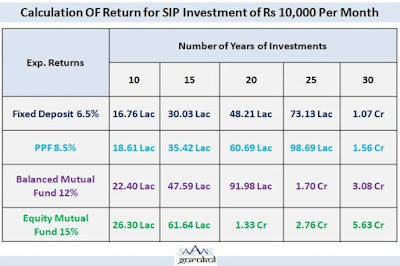

What would

you prefer for your retirement fund after investing Rs 10000 every month for 30

years; Rs 107 lacs or Rs 563 lacs especially when you know the probability of

loss in equity after 10 years is negligible.

The risk you

should take is dependent upon a number of factors, viz.

Your

financial position: income, expenses, assets, liabilities; Family

responsibilities; Your age; The time you have in hand for your goal, your own

risk profile and many such factors.

You must

understand that there are different kinds of risks, some controllable and some

beyond your control.

Ideally, asset allocation has to play an

important role in your investment journey. Consult your wealth manager or

financial advisor to help you choose the most suited asset allocation strategy

for you.A sound Asset allocation strategy will help you optimize the risk,you

need to take to achieve your financial goals.

There are

other asset classes also available, like Real Estate, Gold, Commodities etc.

but the biggest drawback in them is lack of Liquidity, Big-ticket size, leading

to issues of affordability, inadequate diversification and taxation

disadvantages.

Where should

you invest – Finally it boils down to; are you achieving financial goals or

not. The Objective is not to beat the benchmark all the times but to achieve

the financial goals.

The bottom-line

is, if there is a difference between your risk appetite and the risk you require

to take to achieve your financial goals, you need to bridge the gap. Sometimes,

it is ideal to take risk even at a later age to achieve the goals and create

wealth. To have the required money to actualize our dreams, we must take the

necessary risk.

I remember

an old saying, “20 years from now you will be more worried about the things you

didn’t do rather than the ones you did.”

So, are you

taking enough risk?

Consult your

financial advisor today and optimize your risk return balance to achieve your

financial goals.

Happy

Investing!

Stay Blessed

Forever!

Sandeep

Sahni

Note: All information provided

in this blog is for educational purposes only and does not constitute

any professional advice or service. Readers are requested to consult a

financial advisor before investing as investments are subject to Market

Risks.

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA

class of 1988). His also an alum of Shri Ram College of Commerce, Delhi

University (B.Com. Hons. Class of 1985.)

Sandeep's investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and has been advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

He also writes a well read blog;

https://sahayakgurukul.blogspot.com

https://www.sahayakassociates.in/resources/our-blog

He has also conducted presentations, workshops and guest lectures at Management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com

About The author

Sandeep Sahni

Sandeep's investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and has been advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

He also writes a well read blog;

https://sahayakgurukul.blogspot.com

https://www.sahayakassociates.in/resources/our-blog

He has also conducted presentations, workshops and guest lectures at Management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com

Follow us on: