Exercise regularly, go for a walk daily, don’t eat fried food, no junk, no colas, less of sweets, no smoking, limited alcohol, is sound advice for good health. We all know it, but how many of us follow it.

Similarly, good financial advice is, don’t use credit cards, pay off your debts, start early, consult your financial advisor, make your financial goals, decide on your asset allocation, invest for the long term, diversify, don’t try to time the market, review your portfolio regularly, etc., etc.

A couple of years ago, Jason Swieg, the long term writer of the Intelligent Investor column in the Wall Street Journal wrote, “I was once asked, how I defined my job?” He replied, “ My job is to write the exact same thing between 50 and 100 times a year, in such a way that nor my editor, nor my readers should think that Iam repeating myself.”

Essentially, good advice never changes. It will always remain the same with some minor variations.

There are two kinds of people in the world; one who say,

“To believe it, I must see it first”

And the second, who say,

“To see it, I must believe it.”

The first group will always keep on waiting, avoid risk, be skeptical, try to time the market, withdraw on every correction and wait for results to come before they start, and the second group believes the advise of the financial advisor and follow it.

Good financial advice is all about converting the first group to the second group. The only way to do it, is to build the faith and conviction of the investor to invest in the right asset class based on his needs and risk profile.

It is said, “Those who don’t learn from History tend to repeat it.”

We try to build this conviction by studying the past patterns, the history of risk and return, and probability of loss over different time periods of different asset classes. You have to build your conviction so that you are not swayed by the fluctuations and volatility in asset classes.

However, over the years, there are certain financial truths or gospels that have got established.

One of the first things you need to learn is to differentiate between an asset and a liability. An asset is something, which generates income, and liability is something, which depreciates over time. A house in which you live is not an asset; a car is not an asset as it depreciates the moment you buy it. An asset is a house, which fetches you rent or a car, which gets you some lease amount.

Next comes the budget you need to allocate to different expenses.

Senator Elizabeth Warren popularized the 50/20/30 budget rule in her book “All Your Worth: The Ultimate Lifetime Money Plan.” The basic rule is to divide after-tax income, spending 50% on needs or essentials and 30% on wants while allocating 20% to savings.

Needs are those bills that you absolutely must pay and are the things necessary for survival, like food, shelter, education etc.

Wants are all those little extras you spend money on that make life more enjoyable and entertaining.Allocate 20% of your income to savings and investments to take care of your future needs.

Wants are all those little extras you spend money on that make life more enjoyable and entertaining.Allocate 20% of your income to savings and investments to take care of your future needs.

This ratio may change with age, and as you move towards retirement, a greater portion will be allocated to savings and lesser to needs and wants.

Investing is very much like growing a tree; if you can take good care of it at the start, it will take care of itself later. Given lots of tender care, your small baby steps will become your Mighty Money Tree. Your investments in first 5 years, out of a 30 years working life, will generatethe 50% final corpus and the balance 25 years of investment shall make the balance 50% corpus.

That means the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus. Money might not actually grow on trees, unless you plant your own Mighty Money Tree, and early!

So, don’t think there is enough time left, start early and reap the benefits.

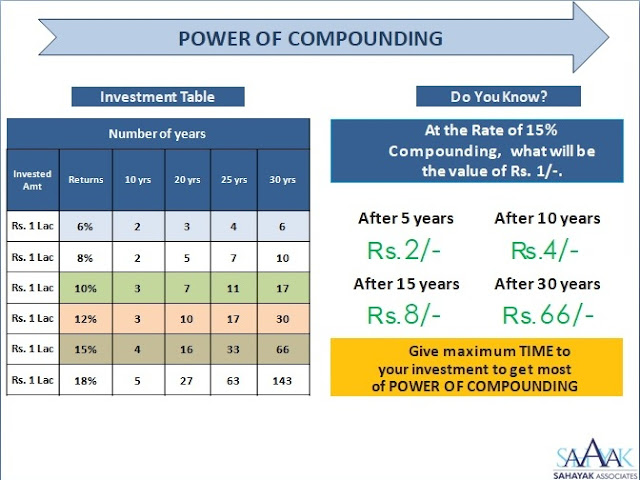

Always remember the “Rule of 72”which says, 72 divided by the returns is the numbers of years it takes for your money to double.

Understand the power of compounding. A small difference of 2-3% in returns can make a major difference in your corpus over a 30-year working life.

An investment of Rs 1 lac in a FD giving 6% return will grow to Rs 6.0 lacs over your working life of 30 years. The same investment in a Hybrid Equity Mutual fund giving around 10-12% return will grow to between Rs 17 to Rs 30 lacs and in an equity mutual fund giving a 14-15% return will grow to Rs 66 Lacs.

A growth journey, ranging from, Rs 6 lacs to 66 lacs, over your working life.

Your Rs 6 lacs at the end of your working life will not even give you enough for one years requirement.

Hence, balance your asset allocation between debt & equity and optimize your returns as compounding makes a major difference in your corpus.

Albert Einstein famously said, “Compounding is the 8thwonder of the World, those who understand it, enjoy it, and those who don’t, pay it.”

One of the best pieces of financial advice I have received is to “Create a Pipeline”. You need to understand the difference between Active income and passive income. All of us are so focused on our work, that we forget to take care of our money.

We do not make our money work for us and give us the return we deserve. You can receive Active income only till you are active and the day you don’t work, that income stops. Passive income is income from Dividends, Equity returns, Interest, Rent, Royalty, Franchise Income, commissions etc.

Today, we recommend to all youngsters to create a financial plan so that by their 40thbirthday, your income from investments( Passive Income) should be equal to or more than your income from profession or business.(active Income) and then you are ready to FIRE (Financially Independent, Retire Early) and have the flexibility to follow your passion or take a sabbatical or do what your heart desires.

Create a pipeline which can keep serving you with regular alternate source of income during your lifetime and for your children thereafter.

Take control of the two basic emotions, Fear and greed in your investment journey. Be afraid when others are greedy and be greedy when others are afraid and you will never go wrong. Most investors follow the herd blindly and make blunders.

Finally, take care of yourself first. Remember the safety drill by the Air Hostess when you board a plane, wherein she emphasizes that first wear the jacket and the oxygen mask yourself before helping others. It’s the same with money and finances, Pay yourself first before you pay the others, plan for your retirement and your goals before anything else.

Ignore Financial Planning at your own peril. The earlier you start planning and caring for your future, the better prepared and organized you will be to give yourself a head start in life, that could help you achieve financial Nirvana.

Financial advice is very simple and easy to comprehend. All jargon, ratios and graphs are only meant to impress you and confuse you. Stick to the basics, ask yourself the basic questions at the start of your financial journey;

1) What is your Financial Goal?

2) Why are you investing?

3) What is your time horizon? When do you need the money?

4) What is your return expectation?

5) How much can you spare and how much do you need to invest to achieve your financial goal?

Consult your advisor, Review your investments regularly, achieve your financial goals and enjoy the journey.

Happy Investing!

Stay blessed forever

Sandeep Sahni

This article was amended on 21 July 2018 to remove incorrect references to the London North West NHS trust. FinancialAdvisor.com.au

ReplyDeleteReally your blog is excellent. Thanks for sharing. Financial advisory company

ReplyDeleteI am really impressed with your blog article, such great & useful knowledge you mentioned here.Your post is very informative. I have read all your posts and all are very informative. Thanks for sharing and keep it up like this.

ReplyDeleteBest Investment Consultants in Nashik

I really appreciate for your efforts you to put in this article, this is very informative and helpful. I really enjoyed reading this blog. Keep sharing and give us more update about Top Investment Advisor Toronto.

ReplyDelete