The two most relevant and frequent questions that we face today from investors are:

Why is the market touching new highs when the Indian economy is faring so poorly and seems to be on a downward spiral ?

And the next immediate question invariably is:

Why is my portfolio doing so badly or underperforming when the Sensex is touching new High ?

Ideally Economy & stock market should have a direct relationship but are currently behaving in a dichotomous fashion. This dissonance between the markets and economic numbers is naturally causing confusion in the minds of investors.

The economy grew at 4.6 % in the Sept Quarter, a 26-quarter low. GFCF (gross fixed capital formation) grew at only 1 per cent thus showing that private investment is truly non-existent. Nominal GDP growth has fallen to a new low of 6.1 per cent, almost halving from the 12 per cent growth number witnessed earlier in the year. The government had budgeted and assumed a nominal GDP growth of 11.5 per cent for

FY 2019-20. The undershooting of nominal GDP will make the achieving of fiscal target even more challenging and lead to its own complications.

Achieving a 20 per cent earnings growth, with nominal GDP at 6 per cent is going to be virtually impossible for the corporate sector. Besides, having nominal GDP growth lower than your incremental cost of borrowing is the path to a debt trap and shall lead to a rise in debt/GDP ratio. If the low nominal GDP growth continues, it is only a matter of time before the ratings agencies get worried again and may downgrade the sovereign rating further making India an unattractive investment destination and cost of capital for foreign borrowing even higher and FDI/FPI to look for other destinations.

Thus, the news on the economy is bad whichever way you look at it and may take another couple of quarters to recover despite some green shootsnow visible since last two months.

With this backdrop, the markets hitting new highs seems very puzzling?

The markets are at all-time highs. BSE Sensex closed at 41681 on Friday, 20th December and the Nifty index surpassed the 12,250 mark, at a time when prime economic indicators and some high-frequency data are at loggerheads with the market’s euphoria.Bank Nifty also touched new highs last week. Buoyancy is visible in equities across the globe in spite of concerns over rich valuations, trillions of dollars in negative interest rates, Trump’s impeachment and other unfavourable geopolitical developments.

However, such a divergence between the real economy and the markets is not uncommon.

The information coming in is always lagged. To cite an analogy, the position of a star in the sky is not actually where we see it. The position we see is what it was when it emitted the light that is reaching us now. It takes a few years for light to travel from the star to our eyes. During this period the star has already moved to another position. Hence, we see the position of the star with a lag effect. Similarly, the economy too has moved out from an unfavourable phase and the impact in the form of higher GDP growth rates and earnings growth would also be seen with a lag.

As they say in the U.S., “a divergence between the Main Street and the Wall Street is not uncommon.” This is because stock markets are a discounting mechanism and are a part of the series of leading economic indicators. They lead the real economy.

Currently, markets are basically saying that we have seen the worst, the economy has bottomed and over the next year/s, economic growth will reaccelerate. Markets are buying into the bullish narrative; that the weak economy will force serious structural reform and change. The government is also responding, nobody expected corporate tax cuts of this magnitude and that too with immediate effect. Most did not expect genuine strategic divestment, but it looks to be happening with government even willing to hand over control in select PSUs. The markets also seem to believe that the upcoming Budget will bring in serious reform of personal taxation and other structural reform measures.

The combination of fiscal and monetary policy support and the Government push will provide the necessary stimulus and work to stabilise the economy and get us back to attractive growth rates. Markets are definitely betting on growth normalisation. While markets may not be clear as to how growth will recover, they are clear that 5 per cent is not the new normal for India and NAMO 2.0 will definitely not want this legacy of 5% growth.

The recent Reserve Bank of India move to conduct its version of ‘Operation Twist’ through simultaneous purchase and sale of government securities under Open Market Operations (OMOs) for Rs 10,000 crore each on December 23 should also result in a boost to the economy by bringing down long-term interest rates.

The second reason for the markets hitting new high is the low interest rates and excess liquidity in the global market. With interest rates abysmally low in some countries and even negative in others, naturally, some of the money in the Global market would find its way into riskier assets and emerging markets. These funds generally chase assets where yields are positive. India’s 10-year domestic benchmark yield is hovering around 6.5%, which is near its five-year lows. This seems to be a cue for traders willing to take some risk and diversify into emerging markets and invest here.

Another reason for the divergence between a slowing economy and robust stock markets is due to retail savings, that is making its way into our equity markets. Indian retail investors continue to have a high degree of optimism regarding stock purchases. Retail systematic investment plan (SIP) flows have been consistently steady, at about ₹8,000 crore a month, providing the much needed impetus to the market and stock prices.

Historically also, in the current century after every decline in GDP growth, the markets have delivered a healthy growth over next five years. The market is expecting a repeat of the same going forward.

The market is being sustained by a “Hope Rally.” What this means is that investors are hoping that as far as the Economy is concerned, the worst is behind us, and they are hoping that stock prices will be higher several months down the road.

Going forward the market is betting on a lot of stimulus. RBI efforts to reduce interest rates, Equity Taxation reform, Personal taxation relief, steps to boost real estate sector, Good rural demand as food inflation is rising, Improved Rabi sowing, visible green shoots since last couple of months in other sectors are some of the positive factors sustaining this hope rally.

Coming to the next question about underperformance of most portfolios despite Index highs.

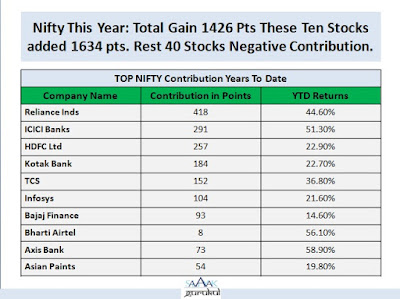

Firstly, we have very polarised markets, i.e. very few stocks are driving the market upwards. Despite the Nifty being at new highs, the mid-cap and small-cap indices are 25 per cent and 40 per cent below their all-time highs. This is entirely a large cap and quality rally. Even within the Nifty 50 index, the entire returns have come from 15 stocks. If you were to divide the Nifty into two buckets, the top 15 performing stocks and the rest, you would find that since December 2017, the top 15 stock index is up about 40 per cent, while the index of the remaining 35 stocks is down 19 per cent.

The market can be currently termed as “ Narrow Bull market and a Broader Bear Market.” The basic point is that this is not a broad-based market advance, indicative of strong and broad economic momentum. Rather it reflects investors herding into quality and large cap stocks at virtually any price. The polarisation in a way reflects the inconsistent growth momentum.

Secondly, you must compare apples with apples. You may be comparing a portfolio which consists of 60 or 70% Equity, due to asset allocation considerations, with an Index which consists of 100% Equity. This comparison may not give an accurate picture.

Asset allocation between Debt and Equity helps reduce the volatility and makes your investment journey smoother apart from optimising the risk and thus is necessary or you may just withdraw from the markets after experiencing the volatility. With a 60/40 mix, you may just not be comparing apples to apples.

In the short term, you may have also bought at a higher price which will average out over the long term and may not matter in the final consideration but may be affecting your return matrix in the current situation.

The final evaluation miscue that can occur is that investors simply do not give their investments enough time to "work." We live in a world of immediate gratification and short-term expectations.However, that just doesn't work when you're evaluating your investment into a stock or series of stocks or funds. Investing successfully in the stock market takes time — a minimum of five years and more. Looking at a strategy's results after only three months, 12 months or even a couple of years may not give you enough data to evaluate whether or not it's a good long-term approach.

Sometimes things will turn out better than you anticipated. Other times you may have to stick it out during a recession. Ultimately, be sure you are evaluating your investments properly so that you truly know if your strategy has worked or failed.

We feel that investors should not judge their investment success by market index comparisons alone but instead, they should evaluate their progress towards achieving personal financial goals. In other words, understand why you are investing and then follow the best strategy to increase the likelihood of reaching your own goals rather than doing short term comparisons.

However, you should consistently evaluate your portfolio and the process for making your investment decisions. It's also important to apply prudent investment principles during this process.

Our sincere suggestion is to concentrate on your financial goals and devise a suitable strategy to achieve the same with the least amount of volatility. Don’t try to time the market, give your investments sufficient time to show the results.

You must consult a professional financial advisor to devise a most suitable strategy for your financial goals.

Stay Blessed Forever!

Happy Investing!

Sandeep Sahni

Note: All information provided in this blog is for educational purposes only and does not constitute any professional advice or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.

About The author

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988). His also an alum of Shri Ram College of Commerce, Delhi University (B.Com. Hons. Class of 1985.)

Sandeep's investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and has been advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.He also writes a well-read blog;

He has also conducted presentations, workshops and guest lectures at Management institutes for students on Financial Planning and Wealth Creation. He can be reached at:

91-9888220088, 9814112988

Follow us on:

Blog Comment Policy

Your thoughts are vital to the health of this blog and are the driving force behind the analysis and calculators that you see here. We welcome criticism and differing opinions. We will do our very best to respond to all comments ASAP. Please do not include hyperlinks or email ids in the comment body. Such comments will be moderated and we reserve the right to delete the entire comment or remove the links before approving them.

Your Blog Information To Good Keep It Up.

ReplyDeleteAlgo Trading