"The Joys of parents are secret; and so are their grief and fears. They cannot utter the one; nor they will not utter the other" wrote Francis Bacon, in the sixteenth century, in his essay on "On Parents and Children"

The best gift we can give our children is Roots and Wings. We give them Roots through good values, and wings through making them dream, and giving them the financial freedom to live their dreams. As parents we need to provide for fulfilling the children’s aspirations, their dreams and giving them the freedom of choice, to follow what their heart desires.

According to the HSBC Value of Education Survey 2018, Nearly 61% of parents wished they had started saving earlier for the goals. As per another study, the 2017 Birla Sun Life Insurance Company Protection Survey, saving for kids’ education was the top worry for nearly 35% of the 1,540 respondents.

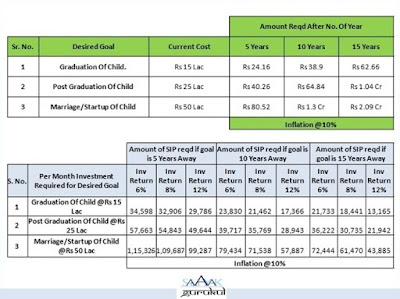

Parents want their children to have a better life than theirs and according to most parents; education is the foundation for a better life. However the rate of inflation in education has been one of the highest in recent times.

I passed out of the best convent school in the region, more than 35 years ago and my annual fees was less than Rs 500 per year and this year when my son finished his schooling from the same school his fees was more than Rs 50000 per year, an increase of more than 100 times. In addition, the cost of tuitions and coaching classes, something unheard of in our times, have not been taken into account, which is equivalent to the school fees currently, if not more.

For my Post Graduation at a leading management institute, 30 years ago, my total expense including living expense, travel etc for a 2 year program was less than Rs 50000 and today it will be close to Rs 5 Million, an increase of more than 100 times once again.

In our interaction with various investors, we have identified that majority of parents make some basic mistakes in planning for their children’s financial requirements:

The different asset classes available today in the market are as follows and should be reallocated and re balanced based on various parameters like time horizon (Years to Goal), amount required for goal achievement, risk taking ability etc.

f) Being scared of Equity and mutual funds due to its volatility without understanding the investment in Mutual Funds

There are different types of mutual funds available which are suitable for different time horizons and risk appetite.

Consult your Financial advisor, Start Early, decide on the current cost, factor in the inflation, determine the asset allocation, review periodically, increase your investment every year with increase in income

and Let your Childs dreams come true.

And Finally, shall like to end with a quote from Warren Buffet, the legendary investor, ““I want to give my kids enough so that they feel that they can do anything but not so much that they could do nothing.”

And Finally, shall like to end with a quote from Warren Buffet, the legendary investor, ““I want to give my kids enough so that they feel that they can do anything but not so much that they could do nothing.”

Happy Childrens Day!

Happy Investing!

Stay Blessed Forever!

Sandeep Sahni

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteindividual stocks

smart investor