Countless Investor interactions later, a pattern of investor portfolio is emerging.

Past experiences have led to biases and have put off most investors from an asset category.

The omnipresence of LIC policies in most portfolios is amazing and most investors have used LIC as an Insurance and saving instrument despite LIC selling it as an insurance and investment, promising the return of total premium paid at the end of the term. By the time you reach the half-century mark and the real mortality risk starts, LIC has returned your money with a 6-7% return and the policy has ended conveniently for them.

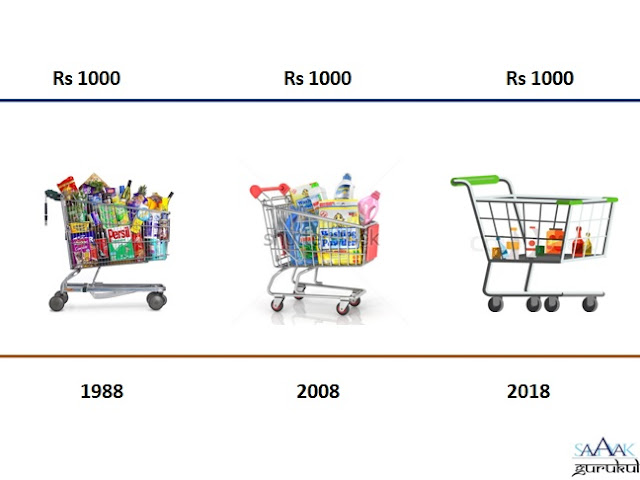

Legacy and conditioning since birth amongst majority have led to a prominence of Bank FD’s and PPF thereby losing out on both compounding and any real return which can beat inflation.

The more “informed” have been dabbling in the stock market and have created a portfolio and forgotten about it, still leading to a low double digit growth with the help of some outstanding “Stars” and several duds.

SIP is the latest fashion statement, but to be aborted whenever the market corrects or in the first instance of requirement of funds as it offers the maximum convenient liquidity.

A major part of the asset allocation is towards Real Estate which over the period has grown due to its illiquidity. Most people consider a House as an asset and whenever an additional amount is available, will invest in another residential plot thereby locking their funds, rather than invest in a commercial property, which can provide rental returns.

I have come across so many business friends who don’t invest in a financial asset due to its liquidity. As their growing business always requires funds, they feel that the liquidity can easily be tapped and will hamper the creation of corpus. Real estate can also be mortgaged to take LAP and other such loans from banks to meet business needs.

Arbitrary investments into convenient asset classes on the pretext of low risk, greater security and bad past experience are the most common excuses provided by investors.

We have met people who have been saving / investing since the last couple of decades without any real wealth creation. This is mainly due to unbalanced asset allocation and failure to acknowledge both, the role of inflation and the power of compounding.

But what has really surprised me is the total lack of financial planning and Goal setting.

Our first question of, “the why of Investing and for what are / should you invest for” draws a blank in most cases.

As humans, we have a hierarchy of needs, a theory propounded by Abraham Maslow in 1943 wherein he has said a lower level need has to be satisfied before one can move on to a higher level.

Essentially, the needs can be classified into deprivation or deficit, safety and finally growth. Individuals must satisfy lower level deficit needs before progressing on to meet higher level growth needs.

Similarly while saving / investing, the “hierarchy of needs” has to be kept in mind.

The basic requirement needs to be fulfilled before you move on to your aspirational and legacy goals.

Just to simplify things, financial goal setting needs to follow a hierarchy, as that will not only decide the amount of investment but also the desired asset allocation strategy.

The first level of financial goal is safety.

Apart from covering the “Roti, Kapda and Makaan”, and in no case do we mean an owned “Makaan” at this stage, Creation of an Emergency Fund should be the first priority. A fund which can take care of your six to twelve months of family expense, in case of loss of job or a temporary layoff due to a medical emergency. This amount has to be safely invested in a highly liquid asset as an immediate goal.

Life is uncertain and not everything can be left to God and the government. You need to take care of the family through adequate health Insurance to ensure coverage of medical costs. Next comes the need to provide for the family in case of the loss of the earning member due to permanent disability or an unfortunate fatality. In present circumstances, Term Insurance is best suited to meet any unfortunate happenings. The amount of term insurance has to cover the cost of any present Debt and a minimum of ten to twenty years of your annual expense, based on the age of your dependents and the number of years required by them to make a fresh independent start. Requirement of your spouse also needs to be factored in while calculating the amount of Term Insurance required.

A one crore term insurance for a forty year old can cost as little as the cost of one dinner at a fancy restaurant every month for a family of four. Set your priorities and before going out for your next family dinner, ensure their dinner for the next twenty years.

The Next level is providing for all the life Essentials.

The essentials are your Children’s education, marriage and retirement planning

In Essentials, the first step is providing for foreseeable short-term needs and goals.

List out your “needs”and “wants” in order of priority. Needs are mandatory and unavoidable whereas the wants can wait till other things are taken care of. A child’s education, marriage etc is a cannot be postponed need whereas the long awaited vacation or SUV though “wanted”, will have to wait till other requirements are taken care of. Any compromise at this stage will lead to higher risk at a later stage to achieve other important financial life goals.

This is the money needed for expenses that you plan to make within the next two to three years. Almost all of this should be in minimal risk, short-term debt instruments.

Based on your goal horizon and time available, a good financial calculator or consultation with a Financial Advisor will help you decide the investment required for meeting the essential short term and long term goals.

Now that your basic financial goals are taken care of and planned, move onto your Aspirational Goals.

The time has come to create your dream, follow your passion. Satisfy your entrepreneurial bug, take a sabbatical, and Plan your Start up at the age of 40 or the house that you had always dreamed of. You may also now plan to satisfy your travel bug. You can now afford to visualize yourself with family in an Alpine Chalet or enjoying the Sunset at a pristine idyllic beach house, all to be achieved through some aggressive investment plans.

A lot of Millenials now are increasing aspiring for FIRE, Financial Independence and Retire Early.A most notable goal to aim for, and not to actually retire early, but to have the financial flexibility to lead and enjoy the life that they want at a relatively ‘younger’ age, to follow their passion and to satisfy their creative side apart from the mundane.

Now you are ready for creating your Legacy.

Decide what you need to bequest to your family favourites, the corpus that you need to leave for your loved ones so that can lead a comfortable life. As Warren Buffet famously said, “Leave enough money for your children, so that they would feel they could do anything, but not so much that they could do nothing.”

Plan your favourite charity, the philanthropy that you always wanted to do, the cause that always touched a cord in your heart. Start keeping aside a sum for these noble activities and build the endowment for your alma mater.

Classify your need for making an investment. One could think of many levels beyond this and really, the details matter much less than the concept. Depending on one's circumstances, any of the levels may have to be modified. For example, you may have enough income-producing assets or a passive income pipeline to make term insurance relatively less important.

Create a system that aims at preventing you from going to higher level unless the lower one is fulfilled. If you haven't put emergency cash in a savings account, then don't buy term insurance. If you don't have term insurance yet, then don't start putting away money for your daughter's college education, not enough planned for your retirement, stop thinking of all those aspirations, and so on.

Start early, check out your risk profile, fix your time horizon, quantify your goals based on present cost, factor in inflation, decide your asset allocation strategy and start investing.

How much to invest is for the next blog. Just remember you need a budget and plan for your money. Income will not determine your wealth, a good financial plan will.

Happy Investing!

Stay Blessed Forever.

Sandeep Sahni